Debt

Port Houston is pleased to provide information on its outstanding debt obligations as part of its commitment to financial transparency. It understands the importance of the Public Trust, and strives to assure that all funds received from public support are used wisely for the best return on investment. Port Houston has prepared a spreadsheet, included in the “Summary” section below, to comply with the requirements of HB 1378 and Section 140.008, Texas Local Government Code, relating to disclosure of debt information.

Port Houston generates positive operating cash flows (i.e., its operating revenues exceed its operating expenses), and uses those excess funds for capital infrastructure investments. At times, when the projected cash flow is insufficient to fully cover the capital improvement plan, Port Houston has obtained approval at a bond election for issuance of ad valorem general obligation tax bonds to supply the shortfall. Property taxes are levied annually to cover the principal and interest debt service payments due on outstanding tax bonds.

The proceeds of past tax bond issuances have been applied towards dredging of the Houston Ship Channel, acquisition of wharf cranes and other major equipment, as well as construction of docks, wharves and container facilities. Port Houston is appreciative of the continued support of taxpayers, labor, industry partners, shippers, officials from local jurisdictions, and many others who have made these capital improvements possible. Such investments contribute to job creation and economic development for the region, state and nation.

Should you have any questions on any of the transparency documents posted on this website, you may contact Port Houston’s Treasury Department at 713-670-2659 or 713-670-2654.

Please note that records older than the information shown below may be located in the Financial Archive.

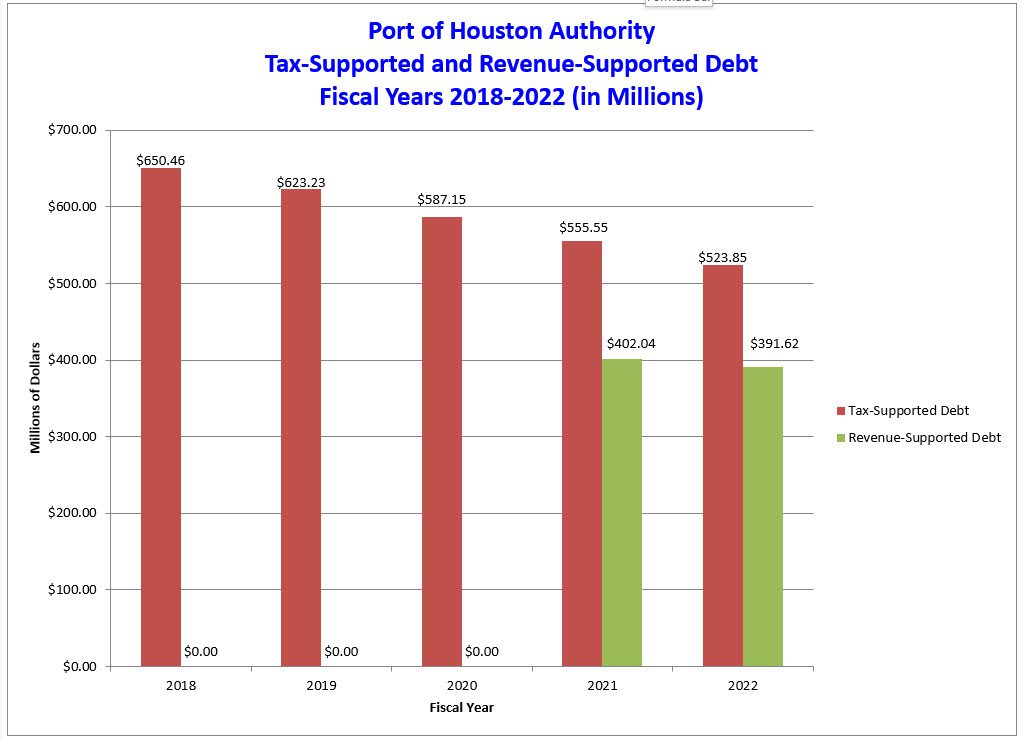

The above tax-supported debt is net of premium / (discount). Port Houston had no outstanding revenue-supported debt during this period.

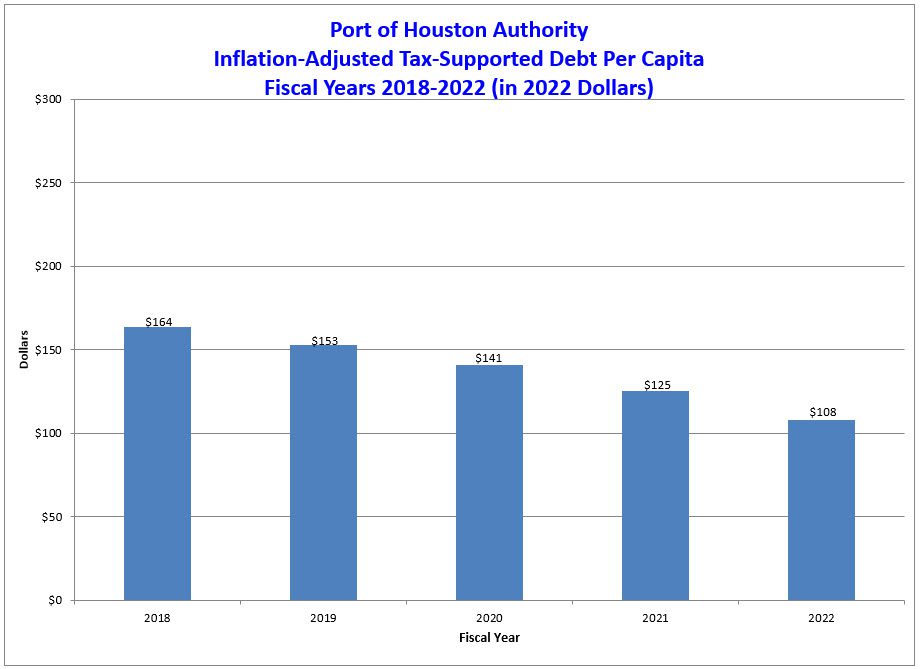

Tax-supported debt is adjusted for inflation based on the Consumer Price Index (CPI), as published by the Bureau of Labor Statistics. Per capita figures are based on Harris County population.

The following documents are available to download in PDF* or Excel format:

Summary

The following provide summary debt information at specific dates, including pages extracted from Port Houston’s Annual Comprehensive Financial Reports (ACFR).

Debt Obligations Star 2016-1214

Disclaimers

Notice and Disclaimer: Information on this website is provided for general informational purposes only and not as a source of investor information. Investor information, including official statements and continuing disclosure, is publicly available on the Municipal Securities Rulemaking Board’s Electronic Municipal Market Access System (“EMMA”) website. No person should make an investment decision in reliance on the information on this website, nor does anything contained on this website constitute an offer to sell securities or the solicitation of an offer to buy securities. Information on this website, including any reports or other documents, contained on this website speak only as of its date. By choosing to view the information on this website you are acknowledging that you have read and understood and accept the terms of this Notice and Disclaimer.

Bond Election Pledge

Port Houston has pledged to post on its website the details of any bond package and existing debt information no later than one business day after public notice of a bond election.

Official Statements

Issuers prepare offering materials so that investors may better assess the risks of owning the issuers’ bonds. The following are the Official Statements for all of Port Houston’s outstanding tax bonds.

Debt Service Schedules

The following schedules provide information on the principal and interest debt service payments due semiannually (April 1 and October 1) on Port Houston’s ad valorem tax bonds and revenue bonds.

Credit Ratings

Notice and Disclaimer: The U.S. Securities and Exchange Commission (www.sec.gov) is responsible for the oversight of credit rating agencies registered as nationally recognized statistical rating organizations (“NRSROs”). Ratings and ratings reports reflect only the views of the NRSROs providing the reports or the ratings, and Port Houston makes no representation as to the appropriateness of the ratings or the information and conclusions contained in the reports. There is no assurance that such ratings will continue for any given period of time or that they will not be revised downward or withdrawn entirely by such agencies. For information regarding the ratings and the ratings reports or actions that may have taken place subsequent to the dates of the reports, readers should contact the NRSROs. Port Houston is not undertaking any obligation to update the ratings information.

Tax Information

Debt service on Port Houston outstanding tax bonds is funded entirely from ad valorem taxes levied by the Harris County Commissioners Court on behalf of Port Houston. Taxes are invoiced and collected by the Harris County Tax Assessor-Collector, which charges a fee for those services. Tax revenues are deposited in a segregated Debt Service Fund restricted for such debt service payments, therefore, tax revenues and debt service payments are excluded from Port Houston’s operating budgets.

Other Debt Information

Notice and Disclaimer: Reports prepared by third parties and links to third party websites are provided herein solely as a convenience. Port Houston has no control over the content of those sites, nor does it endorse or make any representations or accept responsibility about them, or any information or other matters found on those sites.

- Link to EMMA® (Electronic Municipal Market Access)

- Link to TexasTransparency.org

- Link to Texas Comptroller of Public Accounts Debt at a Glance Tool

- Link to Texas Bond Review Board – Local Government Debt Database

PDF documents are available in Adobe Portable Document Format. If you do not have Adobe Acrobat Reader, you may obtain a free copy of the software.