Foreign Trade Zone

Driving Growth

And Innovation

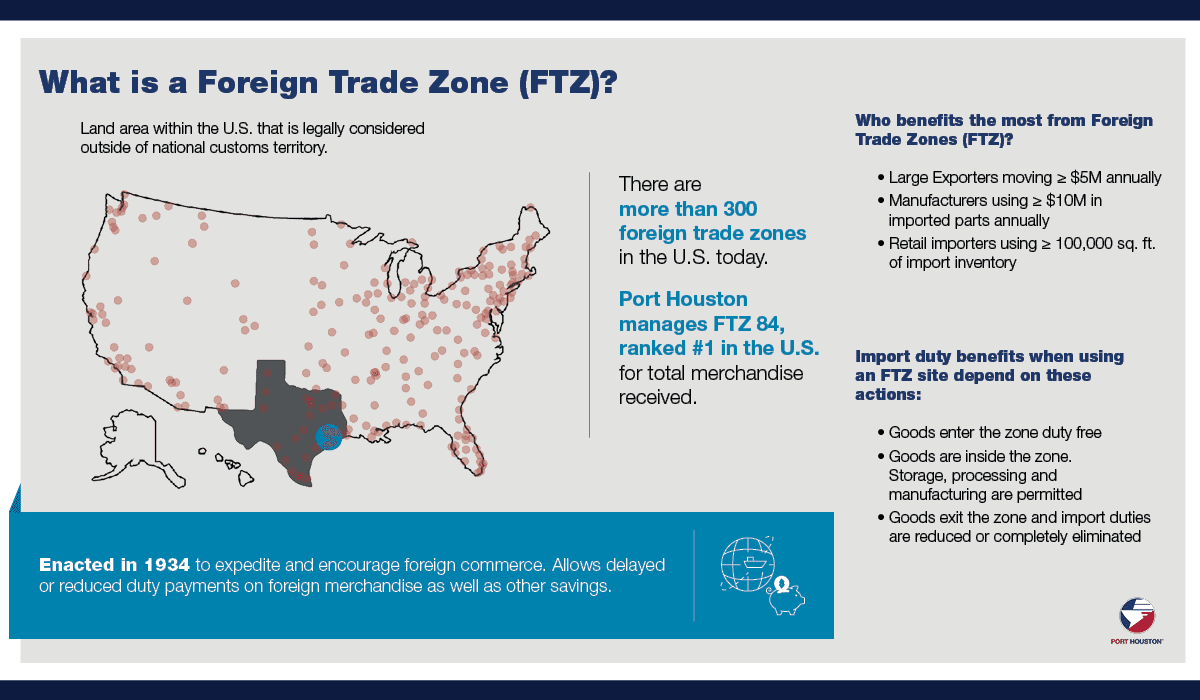

A Foreign Trade Zone (FTZ) is a designated area in which foreign and domestic merchandise is considered by the U.S. government as being outside U.S. Customs territory. These zones can be very beneficial for companies involved in foreign trade, as merchandise may be brought into an FTZ without a formal customs entry, import quotas, and other import restrictions. Duties and excise taxes are not assessed until the merchandise enters U.S. commerce.

Port Houston manages Foreign Trade Zone 84, which includes many port-owned and privately owned sites located throughout Harris, Wharton, and Waller counties. Key benefits include duty elimination, duty deferral, duty exemption on re-exports, ad valorem tax relief, as well as improved cash flow and streamlined logistical benefits.

Application Process for FTZ

The process of obtaining Foreign Trade Zone status begins by first contacting the Port Houston Economic Development team. The Port assists with the application process, and can help companies locate consultants with the specialized knowledge for an in-depth evaluation of the risks and benefits associated with operating in a Foreign Trade Zone.