Pensions & Benefits

Port Houston sponsors several plans intended to provide benefits to eligible active employees, eligible retirees, and their eligible dependents, including:

- Port Houston Restated Retirement Plan, a defined benefit plan, referred to as the “Pension Plan”,

- Port Houston DC Plans, which includes Port Authority contributions to an employee “401(a) Plan” referred to as the “Deferred Contribution Plan” and an employee contribution “457(b) Plan” referred to as the “Deferred Compensation Plan”. Together they are referred to as “DC Plans”.

- Port Houston OPEB Plan, for other post-employment benefits (“OPEB”), such as health and life insurance benefits, provided to eligible retirees and eligible dependents, and

- Port Houston Group Insurance Plan, for certain health and welfare benefits provided to eligible active employees and eligible dependents.

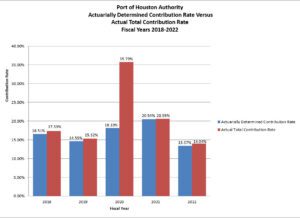

Port Houston has taken proactive steps to ensure that its Pension Plan and OPEB Plan are adequately funded, by committing to fund at least to the level of the Actuarial Determined Contribution each year (“ADC”) as calculated in accordance with actuarial principles.

Port Houston’s retirement plans are subject to various statutory reporting requirements. In compliance with provisions specified in Texas Government Code, Chapters 801 and 802, Port Houston submits reports to the Texas Pension Review Board and is pleased to make such information available to the general public.

Should you have any questions on any of the transparency documents posted on this website, contact Port Houston’s Treasury Department at 713-670-2654 or 713-670-2659.

For questions concerning benefits payments or beneficiaries, contact Port Houston’s Human Resources Department at 713-670-1005.

Please note that records older than the information shown below may be located in the Financial Archive.

Notice and Disclaimer: Information on this website is provided for general informational purposes only and not as a source of investor information. Investor information, including official statements and continuing disclosure, is publicly available on the Municipal Securities Rulemaking Board’s Electronic Municipal Market Access System (“EMMA”) website. No person should make an investment decision in reliance on the information on this website, nor does anything contained on this website constitute an offer to sell securities or the solicitation of an offer to buy securities. Information on this website, including any reports or other documents, contained on this website speak only as of its date. By choosing to view the information on this website you are acknowledging that you have read and understood and accept the terms of this Notice and Disclaimer.

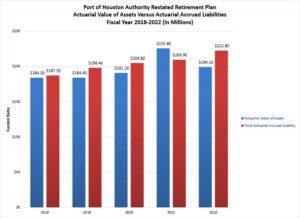

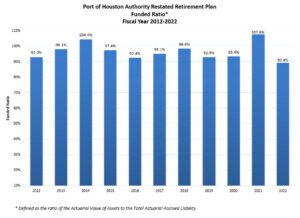

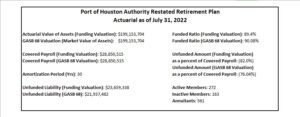

For Fiscal Year 2022, the Pension Plan was well-funded, with a funded ratio of assets to liabilities at 89.4%.

Port Houston has committed to funding at least 100% of the Annual Required Contribution (ARC) amount, as calculated by its actuary. The figures shown above are as a percentage of covered payroll.

The following documents are available to download in PDF or Excel format:

Pension and Benefit Plan Summaries

The following documents provide summary information on the Pension Plan for the last five fiscal years, plus information on how to contact staff and the administrators of Port Houston’s plans.

Administrator Information 2024-0221

Pension Plan

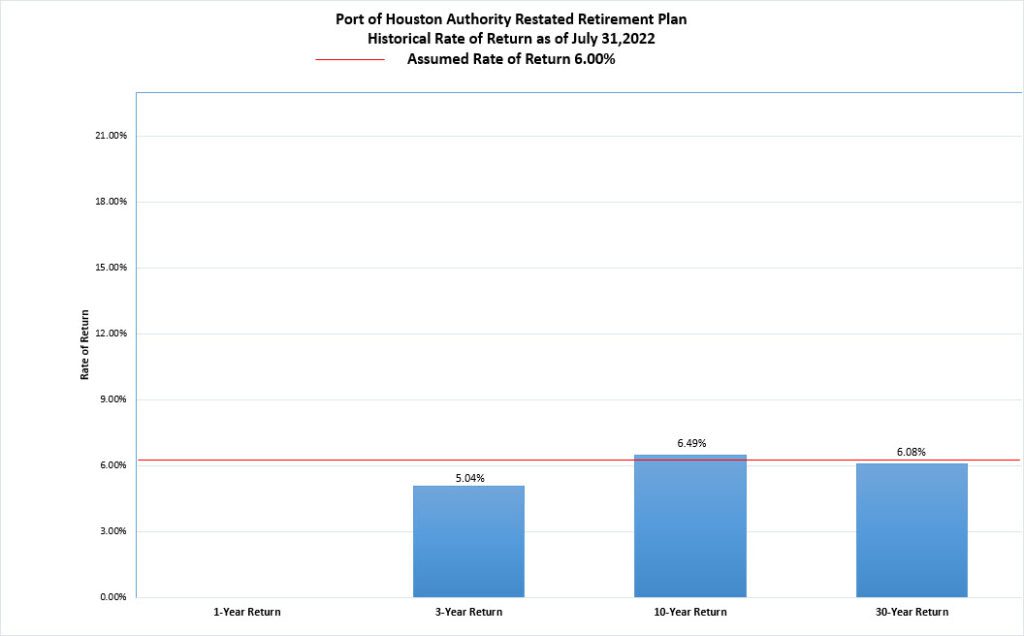

The following documents relating to the Pension Plan, a defined benefit plan, include reports filed with the Texas Pension Review Board, quarterly investment reports, annual valuation reports, etc.

DC Plans

The following documents relate to the DC Plans, which include a defined contribution plan established under Section 401(a) of the Internal Revenue Code of 1986 and a deferred compensation plan established under Section 457(b) of the Internal Revenue Code of 1986.

Contributions to the 401(a) Plan are made solely by Port Houston as employer and covers employees hired on or after August 1, 2012. Contributions to the 457(b) Plan are made solely by the employee and it covers all employees.

OPEB Plan

The following documents relating to the OPEB Plan, for other post-employment benefits, include valuation reports and quarterly investment performance reports for assets placed in an irrevocable trust.

Group Insurance Plan

The following documents relate to the Group Insurance Plan, covering certain health and welfare benefits provided to eligible active employees and eligible dependents.

Transparency in Coverage Final Rule

Please visit the Texas Comptroller of Public Accounts website to access the Public Pension Search Tool.

PDF documents are available in Adobe Portable Document Format. If you do not have Adobe Acrobat Reader, you may obtain a free copy of the software.