Financial Transparency

Leading the Pack

in Transparency,

Ethics, & Fairness

As a navigation district under the Texas Constitution, Port Houston is committed to full financial transparency and accountability. This practice is supported by clean audits, decades of recognition from the Government Finance Officers Association, and awards from the Texas Comptroller Leadership Program.

The Comptroller of Public Accounts launched the Texas Comptroller Leadership Circle program in 2009 to encourage local governments to meet high standards for online financial transparency. Port Houston applied for and received Gold level awards in 2012 and 2013, and Platinum level awards in 2014 and 2015.

In 2016, the Comptroller’s office announced a new Transparency Stars program, recognizing local governments for going above and beyond in their transparency efforts to provide clear and meaningful financial information not only by posting financial documents, but also through summaries, visualizations, downloadable data and other relevant information. More details on this program are available at www.texastransparency.org.

Port Houston was awarded two Transparency Stars in December 2016, in the areas of Traditional Finances and Debt Obligations, and a third one in November 2017 for Public Pensions.

As a navigation district under the Texas Constitution, Port Houston is committed to transparency and accountability. It plays a vital role in facilitating navigation and commerce as the local sponsor of the Houston Ship Channel, a federal waterway, and as owner and operator of the eight public terminals. Port Houston strives to assure that all funds generated from its operations and public support are used wisely for the best return on investment, and in support of its legislative mandate to create jobs and economic opportunity for the region, the State of Texas and the nation.

Port Houston was recognized as the top ranked special district in terms of online financial transparency in a report issued by the Texas Public Interest Research Group (TexPIRG) in April 2017. The report analyzed 79 special districts across the country, and noted that three of the top seven districts were from the Lone Star State. The report is available for download from the TexPIRG website.

Should you have any questions on any of the transparency documents posted on this website, you may submit them online, by clicking on the contacts link at the bottom of this page, or contact the Port Houston’s Treasury Department at 713-670-2659 or 713-670-2654.

Please note: records older than the information shown below may be located in the Financial Archive.

Notice and Disclaimer: Information on this website is provided for general informational purposes only and not as a source of investor information. Investor information, including official statements and continuing disclosure, is publicly available on the Municipal Securities Rulemaking Board’s Electronic Municipal Market Access System (EMMA) website. No person should make an investment decision in reliance on the information on this website, nor does anything contained on this website constitute an offer to sell securities or the solicitation of an offer to buy securities. Information on this website, including any reports or other documents, speaks only as of its date. By choosing to view the information on this website, you are acknowledging that you have read and understood and accept the terms of this Notice and Disclaimer.

We invite you to click any of the following links for information on various areas covered by the Transparency Stars program:

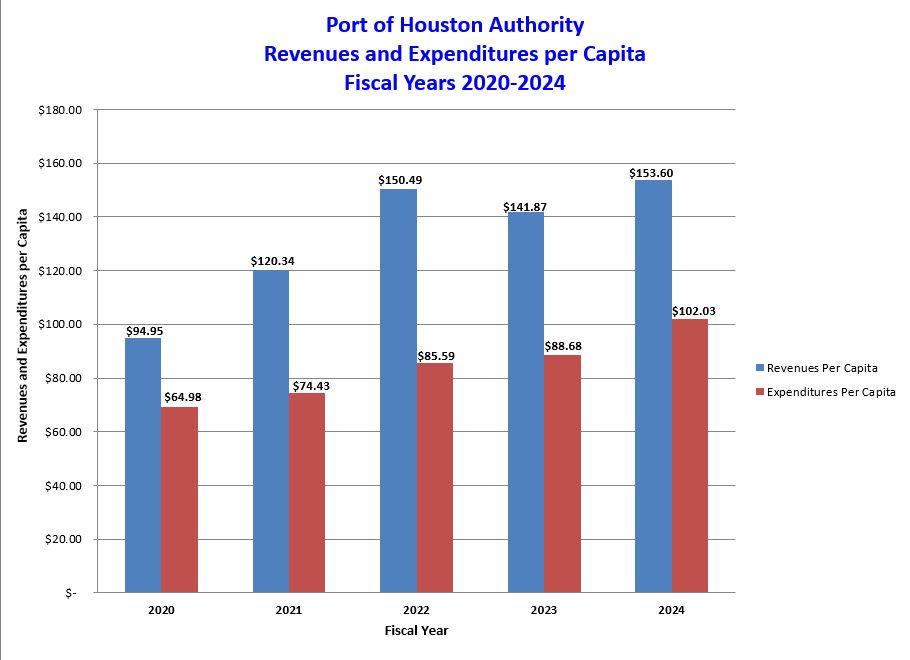

Revenues and expenditures include tax revenues and debt service payments. Per capita figures are based on Harris County population. Port Houston generates excess cash flow of over $150 million annually, which is reinvested in capital infrastructure projects.

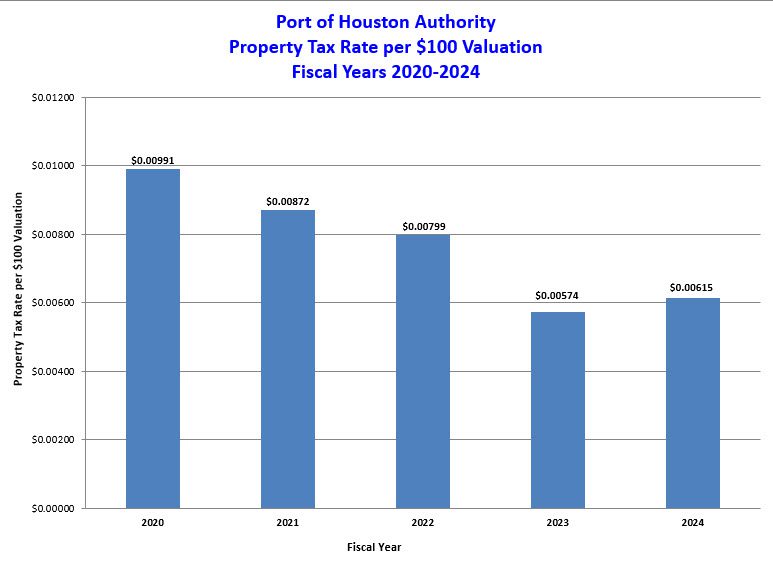

Taxes are levied annually by the Harris County Commissioners Court on behalf of Port Houston, sufficient to cover approximately $40 million in annual principal and interest debt service payments due on Port Houston’s outstanding ad valorem tax bonds.