With a big boom in demand, the Houston region is seeing a steady push in distribution centers and refrigerated cargo warehousing. Large corporations like Target, Ross Dress for Less, Floor & Décor, Maersk and more are investing heavily in the Houston area.

The pandemic has accelerated the demand for industrial space, increasing warehousing developments in the Houston region. According to JLL’s Q2 2022 report, “While inventory and supply chain issues made recent headlines, retail and related industries have continued to take sizable, long-term positions in Houston given its growing population base and strong port.” Additionally, JLL states, “Robust leasing activity continued with 11.4 million square-feet of deals signed, including two transactions over one million square-feet in size.”1

Port Houston saw an increase in tonnage of 15% at the end of 2021, and so far in 2022 there has been no slowing down with a 24% increase in tonnage year-to-date. Much of this surge in demand, has been due to larger volumes of imports and exports around Port Houston’s container terminals. Through July 2022, Port Houston’s container terminals have handled more than 2.2 million twenty-foot-equivalent units (TEUs), an increase of 17% compared to the same time last year.

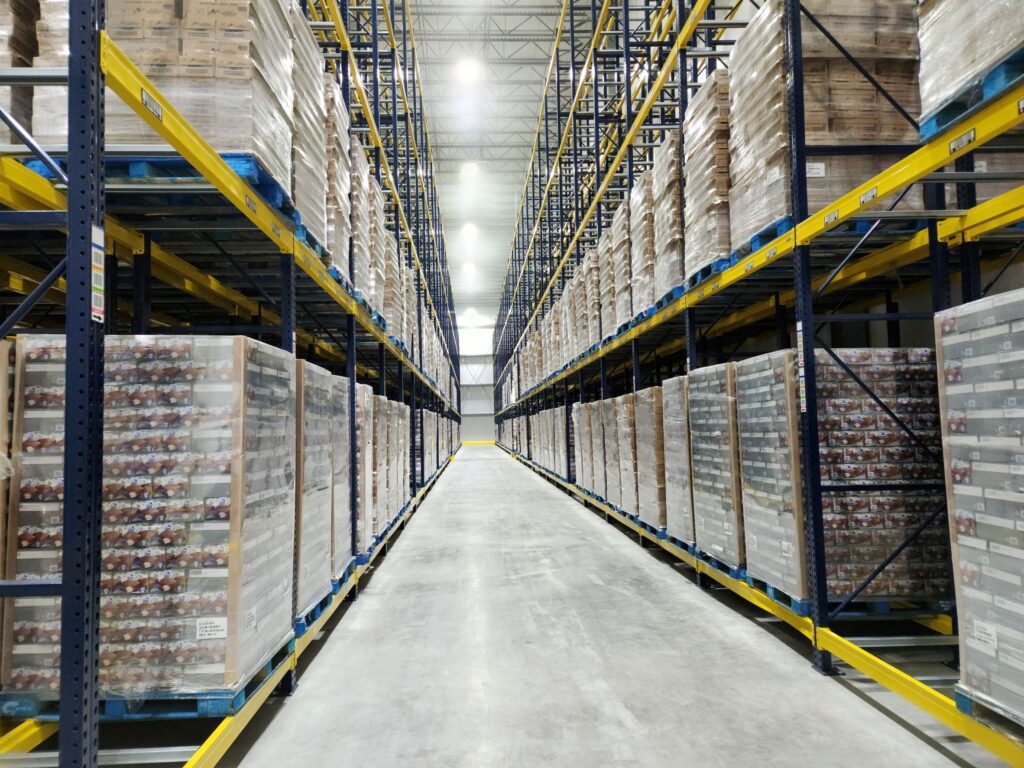

The surge in imports and longer dwell-times has factored into the decision-making by Port Houston leadership to accelerate infrastructure improvements. Port Houston is investing $700 million in the next five years at Barbours Cut and Bayport Container Terminal to advance cargo movement. We’re building new yard space and wharves as well as making improvements to the Houston Ship Channel, Bayport Ship Channel and Barbours Cut Ship Channel to make way for larger cargo vessels. As more goods move across Port Houston’s docks, the need for additional space to store that cargo will continue. We are seeing industrial warehouses in the Port Houston region being built to keep up with demand.

Growth of Distribution Centers

In February 2022, Macy’s Inc. signed an agreement with Tomball City Council to relocate its distribution center to the Lovett Industrial development near the Grand Parkway Toll Road in southern Tomball. The company currently operates out of a facility in Houston but will move to a 900,000-square-foot distribution center within Tomball city limits. Construction on the new facility has begun and is expected to be completed by mid-2023.

Ferguson Enterprises is adding another 750,000-square-foot distribution center to its collection. This DC is among the largest in the Houston region and will give Ferguson a key competitive advantage in the wholesale plumbing products and supplies industry.

Target has invested another five billion dollars in operations and is opening its first sortation centers in Houston and in Dallas. These are the first-of-its-kind concept that help Target stores do even more and strengthen their delivery capabilities for the future.

In 2021, Ross Stores Inc., which owns the Ross Dress for Less and d.d. Discount brands, opened its largest US distribution center in Waller County 20 miles west of Houston. The 2.2 million square foot distribution center in Brookshire was a $300 million project intended to service more than 1,800 stores nationwide.

Floor & Décor and Lowe’s also added 1.5 million square foot distribution centers in Houston and New Caney areas. Webstaurant Store and Article Furniture opened their distribution centers in Baytown with proximity to the Houston Ship Channel.

Cold-Storage Warehouses

The growth in demand doesn’t stop with standardized containers. Port Houston is also seeing a tremendous uptick in reefer (refrigerated) cargo resulting in the construction of new cold-storage facilities and construction plans at Barbours Cut and Bayport Container Terminals to provide more reefer cargo capacity.

In March 2022, Maersk companies chose Houston for its first-ever cold-storage facility which is on track to open in August 2022. The 90-foot unloading dock and temperature-controlled facility will support cold chain services to handle frozen and fresh commodities including fish, poultry, beef, pork, fresh fruits and vegetables. Connectivity through Port Houston and access to rail lines and highways will support Maersk Ocean Services cold chain integration to its current logistics efficiencies.

Custom Goods CES unveiled its new warehouse in Pasadena, TX near Port Houston’s Bayport Container Terminal. This state-of-the-art facility has more than 353,000 square feet of storage space for refrigerated and dry cargo. It’s strategically located between Bayport and Barbours Cut Container Terminal for fast turnover times. This facility is one its final stages of construction and will be fully operational starting in October 2022.

In 2021, Blackline Cold Storage started constructing their new 298,000 square foot cold-storage facility strategically located near Barbours Cut and Bayport Container Terminals. This facility features multiple segregated temperature zones, black freezing capabilities and up to 50 truck doors. The facility at full buildout will expand up to 650,800 square-foot. The Blackline facility represents the newest large-scale cold-storage facility near Port Houston and opened in 2022.

It doesn’t look like the warehousing frenzy will slow down anytime soon. Dallas/Fort Worth, Austin, and Houston are seeing increases in demand for storage space. Retailers in Texas and beyond are investing in Houston thanks to its growing port, a strategic gateway for cargo, centrally located to support movement of goods between Port Houston and inland points.2

References

1 Alexander, R. (2022, July 2). Houston Industrial Insight – Q2 2022 [Review of Houston Industrial Insight – Q2 2022]. JLL. https://www.us.jll.com/content/dam/jll-com/documents/pdf/research/americas/us/q2-2022-industrial-insights/jll-us-industrial-insight-q2-2022-houston.pdf

2 Jensen, G. (2022, July 2). Austin Industrial Insight – Q2 2022 [Review of Austin Industrial Insight – Q2 2022]. JLL. https://www.us.jll.com/content/dam/jll-com/documents/pdf/research/americas/us/q2-2022-industrial-insights/jll-us-industrial-insight-q2-2022-austin.pdf

3 Thomas, N. (2022, July 2). Dallas-Fort Worth Industrial Insight – Q2 2022 [Review of Dallas-Fort Worth Industrial Insight – Q2 2022]. JLL. https://www.us.jll.com/content/dam/jll-com/documents/pdf/research/americas/us/q2-2022-industrial-insights/jll-us-industrial-insight-q2-2022-dallasfort-worth.pdf